Buy-Sell Agreements and Why You Need One

The Purpose of a Buy-Sell Agreement

Creating and funding a buy-sell agreement is one way to assure that there is a smooth ownership transition among co-owners or present and future owners of your closely-held business. Here are the benefits of establishing such a plan:

- When funded properly, buy-sell agreements provide the mechanism and means to effect a transfer of interests upon the occurrence of a death, disability or retirement of a current owner.

- Without funding, the agreement may contain little more than empty promises.

- An insured plan creates the income necessary to fund the agreed transition at the time of need.

Why You Need a Buy-Sell Agreement

- Buy-sell agreements define and financially support the envisioned life events that will trigger the buy or sell.

- The agreement will provide a “market” for the business interest of the owner(s) at retirement, death or disability.

- You can restrict ownership transferability by defining who may own interest in the company.

- Agreements also ensure transfer of a closely held family business to the ”right” family members.

- The buy-sell will fix the value of or establish a method of setting a value for the business.

- Finally, your agreement may provide incentives for younger or minority owners or key executives to either join (recruit) or stay with the business (retain).

Transition and Protection

Buy-Sell agreements are a strategy to support a smooth transition from one owner to the next (or one generation to the next in the case of a family transition). A properly funded agreement will protect the company, the owners and their families against the unexpected cash demands that will occur with an untimely death or disability of an owner.

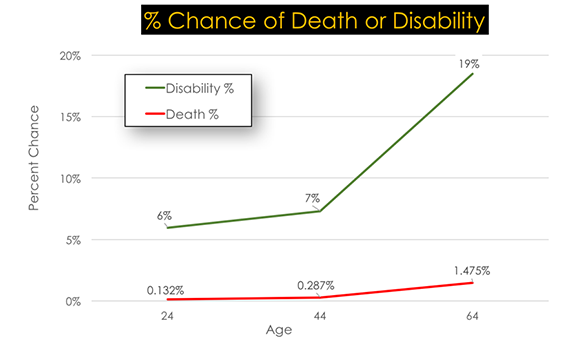

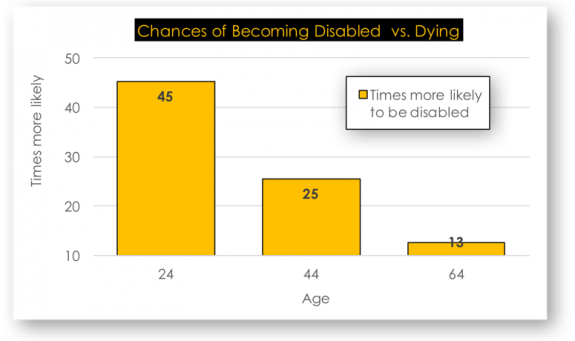

Irrespective of your current health status, you are many times more likely to become disabled rather than die during your career. That’s why protecting your company with a buy-sell that includes life insurance for death and individual disability insurance for a disability occurrence makes sense. These policies assure that in the event of your unexpected death or a career-ending disability, the resources to fulfill your buy-sell agreement will be available. Because you planned well, your company will be able to carry on and you and/or your family will receive the insured business values from the policies.

Establishing a Buy-Sell Agreement for Your Company

Business Planning Group looks forward to working with you on a buy-sell agreement for your company. For most companies, here are the next steps:

- Have a company valuation completed

- Create a buy-sell agreement

- Discuss coverages to insure the transaction

- Implement the plan