The post Phone appeared first on Business Planning Group.

]]>The post Phone appeared first on Business Planning Group.

]]>The post Group Life Webinar appeared first on Business Planning Group.

]]>Group Life Webinar Friday November 13, 2020 10:30 am MST

The post Group Life Webinar appeared first on Business Planning Group.

]]>The post Group Life Plans appeared first on Business Planning Group.

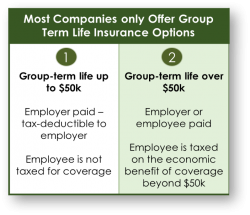

]]>Many employers offer group term life insurance to their employees. The amount typically provided is $50,000 group term life coverage that is “free” to their employees. Group term life is one part of group insurance plans. Companies can also offer “enhanced” group term life insurance, usually expressed as X times salary.

Employees can also opt into a plan to purchase group permanent life insurance. They have the option to elect a salary reduction for a portion of their payroll; similar to a 401(k) plan into the enhanced group term or group permanent life options. When the employee makes a contribution, only a portion of the contribution will be counted as income and taxed in the current year. Although the group permanent life option is traditionally used by owners and key employees because of the initial tax savings, future tax-free income, and other benefits, it is available to all qualifying employees to consider.

Employer advantages for adopting a group permanent life offering

When your company adopts a group permanent life plan, there are significant employer advantages, among those are:

- There is no mandatory employer contribution

- Plans funded with voluntary salary deferrals

- Contributions made to the plan (whether EE or ER paid) are paid by the company and 100% deductible by the company in the year paid

- Payroll taxes owed by the company are reduced by the reduction of participant(s) W-2 wages

Employer advantages for adopting a group permanent life offering

When your employees participate in a group permanent life plan, there are significant employee advantages, among those are:

- Employees can defer a significant portion of their W-2 wages

- Plan participation reduces the employee W-2 and associated Federal, state and payroll taxes

- Plan uses pre-tax dollars; only a portion of plan contributions are includible in the participant’s income. Contribution discounts are typically 30% to 40% due to tax-savings on Federal, state and payroll

- Plan assets accumulate on a tax-deferred basis

- Plans includes accelerated benefit “living” riders

- In the event of a participant’s death, a tax-free survivor benefit is provided

- During retirement, all income is received tax-free through policy cash value loans

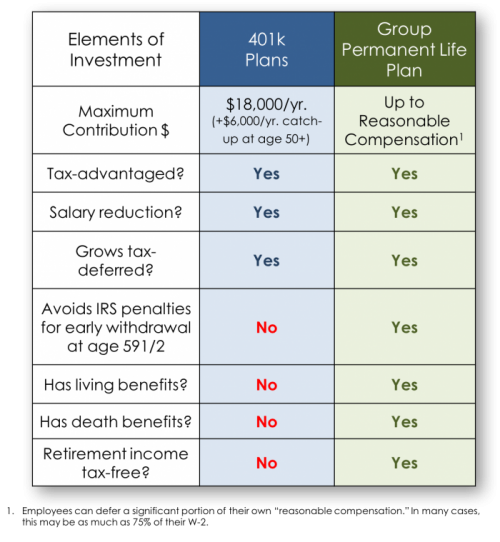

How a group permanent life offering compares to your 401k plan

A company sponsored group permanent life plan can complement your company 401(k) plan. Here’s a comparison for review:

Group permanent life plans can complement your 401k plan with additional benefits and larger contributions.

Want to learn more about group life plans and permanent group life?

If you’d like to learn more about group life plans and permanent group life for your organization, please contact Business Planning Group for a free consultation.

The post Group Life Plans appeared first on Business Planning Group.

]]>The post Buy-Sell Agreements and Why You Need One appeared first on Business Planning Group.

]]>The Purpose of a Buy-Sell Agreement

Creating and funding a buy-sell agreement is one way to assure that there is a smooth ownership transition among co-owners or present and future owners of your closely-held business. Here are the benefits of establishing such a plan:

- When funded properly, buy-sell agreements provide the mechanism and means to effect a transfer of interests upon the occurrence of a death, disability or retirement of a current owner.

- Without funding, the agreement may contain little more than empty promises.

- An insured plan creates the income necessary to fund the agreed transition at the time of need.

Why You Need a Buy-Sell Agreement

- Buy-sell agreements define and financially support the envisioned life events that will trigger the buy or sell.

- The agreement will provide a “market” for the business interest of the owner(s) at retirement, death or disability.

- You can restrict ownership transferability by defining who may own interest in the company.

- Agreements also ensure transfer of a closely held family business to the ”right” family members.

- The buy-sell will fix the value of or establish a method of setting a value for the business.

- Finally, your agreement may provide incentives for younger or minority owners or key executives to either join (recruit) or stay with the business (retain).

Transition and Protection

Buy-Sell agreements are a strategy to support a smooth transition from one owner to the next (or one generation to the next in the case of a family transition). A properly funded agreement will protect the company, the owners and their families against the unexpected cash demands that will occur with an untimely death or disability of an owner.

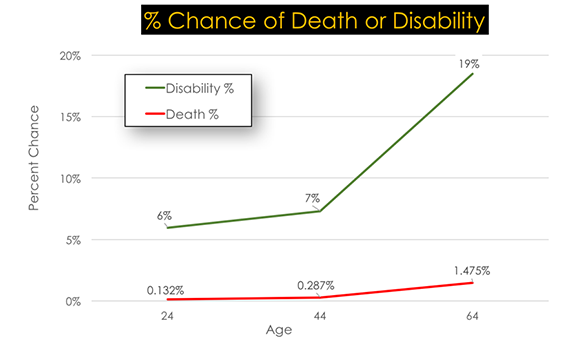

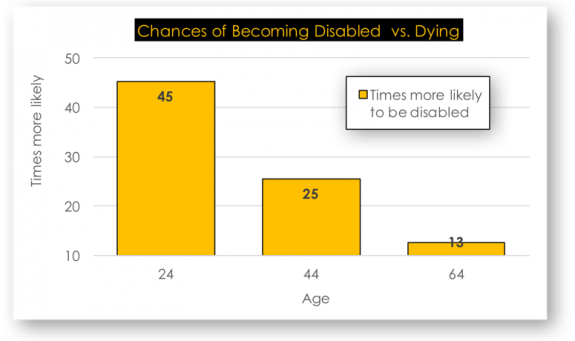

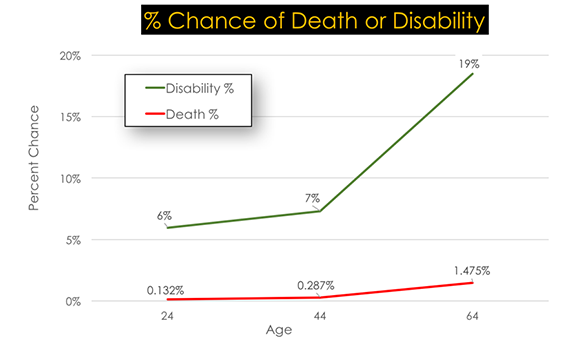

Irrespective of your current health status, you are many times more likely to become disabled rather than die during your career. That’s why protecting your company with a buy-sell that includes life insurance for death and individual disability insurance for a disability occurrence makes sense. These policies assure that in the event of your unexpected death or a career-ending disability, the resources to fulfill your buy-sell agreement will be available. Because you planned well, your company will be able to carry on and you and/or your family will receive the insured business values from the policies.

Establishing a Buy-Sell Agreement for Your Company

Business Planning Group looks forward to working with you on a buy-sell agreement for your company. For most companies, here are the next steps:

- Have a company valuation completed

- Create a buy-sell agreement

- Discuss coverages to insure the transaction

- Implement the plan

The post Buy-Sell Agreements and Why You Need One appeared first on Business Planning Group.

]]>The post Business Valuation for Your Business? appeared first on Business Planning Group.

]]>It may seem counter-intuitive to get a business valuation when you are probably not ready to sell your business. Still, when you know your business value, you unlock valuable understandings for the future of your business. Knowledge about your business value gives you a big head start on major corporate events like succession or exit planning, buy/sell planning, debt or equity financing, justification of share values, tax reporting and even litigation.

When you think about your the future of your business, consider the types of business transfers that can occur:

- Internal – selling or gifting your business to a company insider such as a family member, manager(s) or key employee(s).

- External – selling to an entity that is not in your company now. These may include competitors, customers or even investor(s).

Business Valuation Methods

- Market approach business valuation methods – Market approach estimates of the business value by comparing the company to recent selling prices of similar businesses.

- Earnings or Income approach business valuation methods – These valuations determine the cash flow of the company using normalized past earnings to evaluate what future earnings may be. Those earnings are then evaluated through a capitalization factor (a rate of return that a purchaser would expect to make).

- Asset-based business valuation methods – These types of valuations are done on a going concern or on a liquidation basis. The basic valuation methods involves understanding the business net assets (for a going concern) or net cash (in a liquidation situation).

- Enterprise value business valuation methods – This value is the total value of the firm, all equity plus all long-term debt.

For your company, you should know the answer to the one big question, “what’s my company worth?” Business Planning Group looks forward to working with you to get a business valuation for your company.

The post Business Valuation for Your Business? appeared first on Business Planning Group.

]]>The post Executive Benefits appeared first on Business Planning Group.

]]>Executive benefit plans can be used to provide specific benefits to business owners, executives, and key employees. Executive benefit plans assist owners and employees in accumulating and protecting wealth while deferring income taxes until retirement. Once in retirement, you may be able to withdraw your funds at a lower tax rate, or even tax-free. Most of our executive benefit plans can be customized for your organization and will work alongside your company’s current benefit programs!

Using Executive Benefits

In today’s ultra-competitive market, recruiting and retaining key employees is an important part of building a competitive organization. In such an environment, losing any key team member can be a devastating loss to your company. Whether you’re an owner or HR director, the top performers in your company and those you seek to recruit into the company are looking for you to recognize their value to the organization. Rewarding your joint successes with lucrative executive benefits is a great way to say ”you’re on my team!” Customized plans are often used with employee agreements to create golden handcuff arrangements needed to retain key employees with the company. Executive benefits can also be tax deductible for the employer and partially or fully taxable to the employee.

Types of Executive Benefits

Sometimes referred to as “non-qualified plans”, executive benefits are generally exempt from Department of Labor (DOL) discrimination rules and top heavy testing to which qualified plans are subject. In addition to uses as a recruiting and retention tool, executive benefits can be used in buy-sell agreements; succession planning or for pre-funding buyouts.

Executive Benefits Plan Types Include:

- Leveraged premium plans

- Section 162 executive bonus plans

- Split dollar plans

- Buy-sell purchase agreement plans

- Key person insurance

- Deferred compensation plans / SERP

If you’d like to learn more about the details of executive benefits, download the PDF booklet to the right. If you are ready to discuss how executive benefit plans can be used inside your organization, please contact Business Planning Group for a free consultation.

The post Executive Benefits appeared first on Business Planning Group.

]]>The post Dealing with Equity Market Risks appeared first on Business Planning Group.

]]>Now, according to some well-known investors, the current equity market may be due for a harsh correction*. That’s the view of Mr. John Hussman, President of the mutual fund Hussman Investment Trust, and Stanford University economics PhD. In March of this year (2017), writing in Fortune.com, Hussman says you can expect the S&P 500 to return no more than 1% on average over the next decade. Sooner than that, he predicts, the stock market may plunge as much as 60%. Hussman calls the current environment “the most broadly overvalued moment in market history.” Stocks have now gone eight years without a bear market; a drop of 20% or more. That’s much longer than usual and a red flag for many warning that the market is due for a dip.

For your personal planning, retirement, and estate building purposes, investing or continuing to invest into the current equity market risks may not be right for you. As a reminder, in the last major market retreat of October 2007, the Dow Jones average retreated from 14,164 to 6,547, by March 2009, a 53.8% drop. Then, it took until March 2013 to get back to the October 2007 levels.

If a major market correction should occur in the near future, waiting years for market losses to be recaptured may not work with your plans. Also, if you are in retirement, and such losses were incurred, your tax-deferred plans will still have IRS required minimum distributions, which will reduce your account balances even more.

If you’d like to learn more about equity market risks, download the PDF information to the right. Fortunately, there are options to handle this continued equity market risk. If you are concerned about equity risk, give Business Planning Group a call and let’s discuss options for you to eliminate or at least reduce your current equity market investment risks.

Source: *http://fortune.com/2017/03/09/stock-market-sell-bubble/

The post Dealing with Equity Market Risks appeared first on Business Planning Group.

]]>The post Accumulating and Protecting Wealth appeared first on Business Planning Group.

]]>Our goal is to assist you in understanding the opportunities and potential rewards that are available when you take a proactive approach to your business and personal financial situation.

Our strategy is to create customized financial solutions to handle your two distinct financial phases; the accumulation phase and the preservation phase.

The investment phases

The accumulation phase occurs during your working years. At this time it may be appropriate to:

- Take higher risk while seeking higher returns

- Seek asset growth while working and contributing

- Understand that you may have time to make up for investment mistakes and losses

The preservation phase is when you’re preparing for retirement. During this time it’s important to:

- Realize that you have an unknown time horizon

- Prepare for the possibility of additional and significant life costs, especially future medical expenditures

- Take lower investment risks and contemplate a reduction in spending

- Understand that unlike in the accumulation stage, you probably will not have time to make up for large investment losses in the preservation stage

Inflation

What about the effects of inflation on my wealth? Fortunately, inflation has been relatively low (under 5.0% since the late 1980’s). However, many remember the late 1970’s and early 1980’s when inflation was running over 10% per year! So, planning for some inflation going forward only makes sense. As an example, if you are 65 years old today and wanted to know how much you’d need in at various ages in the future at just 3.0% inflation to replace $50,000 today:

- At age 75, you’d need $67,200

- At age 85, $90,300 and

- At age 95, you’d need over $121300.

Whether you are in the accumulation or preservation phase of your life, at Business Planning Group, we provide customized financial solutions to help you prepare for your future. If you’d like to learn more about accumulating and protecting your wealth, please download our PDF booklet to the right. If you’d like to discuss your situation, give us a call and let’s discuss how we can assist you during your transition.

The post Accumulating and Protecting Wealth appeared first on Business Planning Group.

]]>The post Recruit, Retain, and Reward Key Employees appeared first on Business Planning Group.

]]>Recruiting Key Employees and Executives

Building a high-performing organization has always been critical to maintaining your firms competitive market position. In today’s employment market, that’s even more difficult as workforce changes are creating:

- A shortage of qualified workers in almost all crucial areas, a trend most likely to continue as baby boomers continue to retire.

- This smaller, experienced, talent pool creates an even greater competition to recruit and hire “top” performers. This has stimulated higher salaries, more benefits and even signing bonuses for key recruits.

- Employee turnover, especially in key positions, is costly for businesses in lost time, lower work productivity, quality problems, lower income and even lost customers.

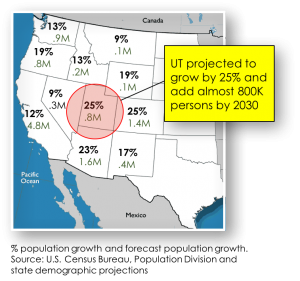

Utah experiencing rapid population growth

You already knew that Utah is growing rapidly but here are the facts to support that awareness. Utah’s current population in 2016 was 3,061,160. According to the Gardner Policy Institute at the University of Utah, our state’s population is expected to grow to 3,829,201 by the year 2030 (+25%). While that may sound like big growth, competition for hiring top talent is certain to be region wide throughout the Western U.S. Utah’s projected growth of almost 800k new citizens is just 6.6% of the total Western U.S. projected growth of 11.8 million new Westerners! That means that other Western states will be recruiting our most talented people. Attracting and retaining qualified employees in this high growth environment presents an unprecedented recruiting challenge for competitive companies to keep up with population driven business growth while defending your employees from other companies throughout the West.

Retaining and Rewarding

Now that your company has recruited the “best” people for your company, how do you retain them?

Business Planning Group can assist your company to develop, launch, and manage targeted employee and executive benefit plans. These plans will tie employee retention to compensation over a timeline that will keep your key employees on the job. We do this by developing customized benefit plans, targeted towards key employees, offering them financial advantages in a way that will keep them with your company for the long-term.

If you’d like to learn more about the details of targeted executive benefits for recruiting and retaining key personnel, download our e-material to the right. If you are ready to discuss how these executive benefit plans can be used inside your organization, please contact Business Planning Group for a free consultation.

The post Recruit, Retain, and Reward Key Employees appeared first on Business Planning Group.

]]>The post Disability Income for Key Employees and Owners appeared first on Business Planning Group.

]]>While most companies recognize the importance of carrying life insurance on the owner and key employees, the facts show that an unexpected disability as far more likely to occur than a death. That means, without individual disability insurance on your key employees (and yourself), your organization could be missing a vital aspect of insurance coverage that helps ensure the financial security of your key talent and even your company.

Unfortunately, many companies and professionals discover this the hard way; when a highly compensated executive or professional suffers a long-term illness or serious accident and has to manage a physical recovery with as little as 20% – 40% of their pre-disability income.

What’s the risk?

- Your biggest Asset – Your ability to earn an income is what makes all things possible.

- The company needs you – If you are an owner or key employee, how will your role be met if you cannot work?

- Bucking the trends – People are simply living and working longer today. With each new role, comes added responsibility to yourself, the company and your family. Your ability to earn is your biggest asset by far.

Goals of an Individual Disability Income plan:

- We can help you improve the value of benefit expenditures for yourself and key employees

- Your new individual disability income plan plan will promote long term employment stability among your key employees

- Having your own individual disability income plan will eliminate the discrimination towards owners and key employees that exists with group long term disability plans

- Your new plan creates a workable solution for you and other key employees in the event of a disability.

Let’s talk about what we can do about making sure that a disability doesn’t ruin your company financially or devastate a family. Business Planning Group can assist you in developing, launching, and managing an individual disability plan to insure you and you r key employees. We can do this by developing a customized benefit plans that meets the needs of the owners and key employees.

chart sources: https://www.dol.gov/odep/topics/disabilityemploymentstatistics.htm and https://www.ssa.gov/oact/STATS/table4c6.html

The post Disability Income for Key Employees and Owners appeared first on Business Planning Group.

]]>