Funding the Future with Leveraged Premium

Leveraged premium plans enable clients to leverage liquid assets to fund a life insurance policy. With a leveraged premium financing arrangement, the insured (or the insured’s trust or corporation) takes out a loan from a lender to pay the premiums on a life insurance policy. Here are a few benefits of leveraged premium plans:

- Funds are loaned, not earned. Leveraged plans reduce liquidity needs. This is helpful if your assets are not readily convertible to cash or are committed to other investments or expenses.

- You have an insurance need but current assets are employed in investments with returns that are higher than the cost of borrowing.

Leveraged premium plans have many uses, including:

- Retirement income planning

- Prefunding of a corporate buyout

- Estate maximization

- Estate Tax Replacement

- Legacy Planning

- Corporate liquidation value replacement

- Estate liquidity

- Corporate benefit planning

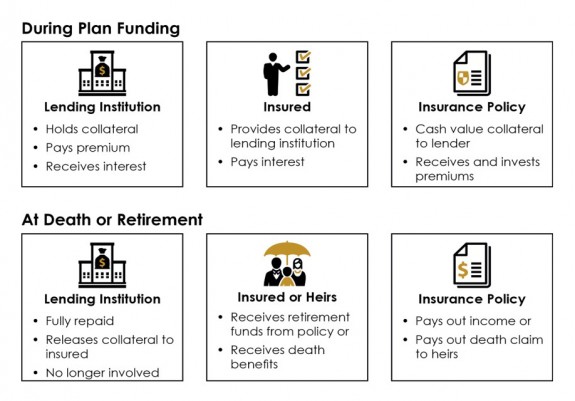

Here’s how leverage premium plans work:

Tax Considerations

- Interest on a loan to acquire life insurance is generally

considered personal interest and not tax deductible. - Since loans to a trust for premium payments are not taxable gifts, gift taxes can be minimized.

- Estate maximization

- Providing a personal guarantee or collateral on a loan does not cause an incident of ownership in the policy.

- If a policy can be structured inside of an irrevocable life insurance trust (ILIT), the policy and proceeds can be excluded from your estate value.