Group Life Plans

What are Group Life Plans?

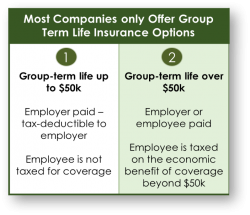

Many employers offer group term life insurance to their employees. The amount typically provided is $50,000 group term life coverage that is “free” to their employees. Group term life is one part of group insurance plans. Companies can also offer “enhanced” group term life insurance, usually expressed as X times salary.

Employees can also opt into a plan to purchase group permanent life insurance. They have the option to elect a salary reduction for a portion of their payroll; similar to a 401(k) plan into the enhanced group term or group permanent life options. When the employee makes a contribution, only a portion of the contribution will be counted as income and taxed in the current year. Although the group permanent life option is traditionally used by owners and key employees because of the initial tax savings, future tax-free income, and other benefits, it is available to all qualifying employees to consider.

Employer advantages for adopting a group permanent life offering

When your company adopts a group permanent life plan, there are significant employer advantages, among those are:

- There is no mandatory employer contribution

- Plans funded with voluntary salary deferrals

- Contributions made to the plan (whether EE or ER paid) are paid by the company and 100% deductible by the company in the year paid

- Payroll taxes owed by the company are reduced by the reduction of participant(s) W-2 wages

Employer advantages for adopting a group permanent life offering

When your employees participate in a group permanent life plan, there are significant employee advantages, among those are:

- Employees can defer a significant portion of their W-2 wages

- Plan participation reduces the employee W-2 and associated Federal, state and payroll taxes

- Plan uses pre-tax dollars; only a portion of plan contributions are includible in the participant’s income. Contribution discounts are typically 30% to 40% due to tax-savings on Federal, state and payroll

- Plan assets accumulate on a tax-deferred basis

- Plans includes accelerated benefit “living” riders

- In the event of a participant’s death, a tax-free survivor benefit is provided

- During retirement, all income is received tax-free through policy cash value loans

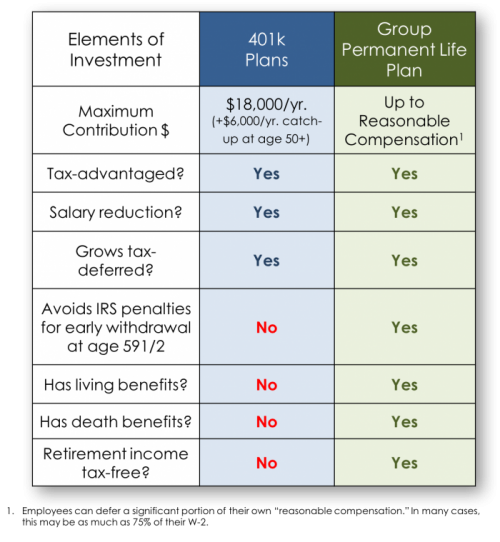

How a group permanent life offering compares to your 401k plan

A company sponsored group permanent life plan can complement your company 401(k) plan. Here’s a comparison for review:

Group permanent life plans can complement your 401k plan with additional benefits and larger contributions.

Want to learn more about group life plans and permanent group life?

If you’d like to learn more about group life plans and permanent group life for your organization, please contact Business Planning Group for a free consultation.