The post Dealing with Equity Market Risks appeared first on Business Planning Group.

]]>Now, according to some well-known investors, the current equity market may be due for a harsh correction*. That’s the view of Mr. John Hussman, President of the mutual fund Hussman Investment Trust, and Stanford University economics PhD. In March of this year (2017), writing in Fortune.com, Hussman says you can expect the S&P 500 to return no more than 1% on average over the next decade. Sooner than that, he predicts, the stock market may plunge as much as 60%. Hussman calls the current environment “the most broadly overvalued moment in market history.” Stocks have now gone eight years without a bear market; a drop of 20% or more. That’s much longer than usual and a red flag for many warning that the market is due for a dip.

For your personal planning, retirement, and estate building purposes, investing or continuing to invest into the current equity market risks may not be right for you. As a reminder, in the last major market retreat of October 2007, the Dow Jones average retreated from 14,164 to 6,547, by March 2009, a 53.8% drop. Then, it took until March 2013 to get back to the October 2007 levels.

If a major market correction should occur in the near future, waiting years for market losses to be recaptured may not work with your plans. Also, if you are in retirement, and such losses were incurred, your tax-deferred plans will still have IRS required minimum distributions, which will reduce your account balances even more.

If you’d like to learn more about equity market risks, download the PDF information to the right. Fortunately, there are options to handle this continued equity market risk. If you are concerned about equity risk, give Business Planning Group a call and let’s discuss options for you to eliminate or at least reduce your current equity market investment risks.

Source: *http://fortune.com/2017/03/09/stock-market-sell-bubble/

The post Dealing with Equity Market Risks appeared first on Business Planning Group.

]]>The post Accumulating and Protecting Wealth appeared first on Business Planning Group.

]]>Our goal is to assist you in understanding the opportunities and potential rewards that are available when you take a proactive approach to your business and personal financial situation.

Our strategy is to create customized financial solutions to handle your two distinct financial phases; the accumulation phase and the preservation phase.

The investment phases

The accumulation phase occurs during your working years. At this time it may be appropriate to:

- Take higher risk while seeking higher returns

- Seek asset growth while working and contributing

- Understand that you may have time to make up for investment mistakes and losses

The preservation phase is when you’re preparing for retirement. During this time it’s important to:

- Realize that you have an unknown time horizon

- Prepare for the possibility of additional and significant life costs, especially future medical expenditures

- Take lower investment risks and contemplate a reduction in spending

- Understand that unlike in the accumulation stage, you probably will not have time to make up for large investment losses in the preservation stage

Inflation

What about the effects of inflation on my wealth? Fortunately, inflation has been relatively low (under 5.0% since the late 1980’s). However, many remember the late 1970’s and early 1980’s when inflation was running over 10% per year! So, planning for some inflation going forward only makes sense. As an example, if you are 65 years old today and wanted to know how much you’d need in at various ages in the future at just 3.0% inflation to replace $50,000 today:

- At age 75, you’d need $67,200

- At age 85, $90,300 and

- At age 95, you’d need over $121300.

Whether you are in the accumulation or preservation phase of your life, at Business Planning Group, we provide customized financial solutions to help you prepare for your future. If you’d like to learn more about accumulating and protecting your wealth, please download our PDF booklet to the right. If you’d like to discuss your situation, give us a call and let’s discuss how we can assist you during your transition.

The post Accumulating and Protecting Wealth appeared first on Business Planning Group.

]]>The post Tax-free income with Tax Conversion Plans appeared first on Business Planning Group.

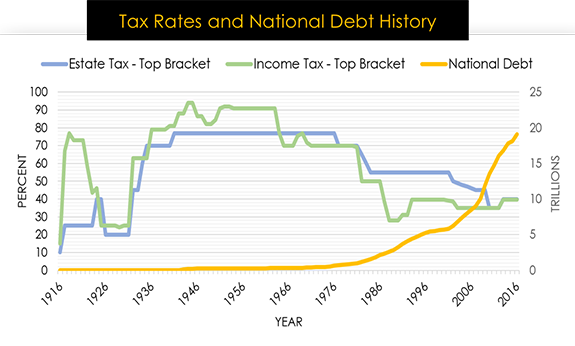

]]>As our government struggles with growing debt, large deficits and spending levels, tax rates will no doubt be reevaluated and adjusted. Now fixed at the lowest historical levels for the last 80 years, when tax rates do go higher, the benefits of financial planning for the management of personal taxation will become increasingly important.

Without knowing what future tax rates will be, it will be in your best interest to plan to reduce both current and future taxation.

Managing Taxes

In order to reduce current taxes during your working years, people often invest in qualified plans such as IRA’s and 401(k) plans which provide the benefit of deferring taxation until you retire. However, Tax law requires qualified plan owners to begin taking “required minimum distributions” from their accounts, each year beginning at age 70½. The amount that must be taken from the account in any year is based on the age of the account owner. Required minimum distributions range from 3.7% of the account balance at 70½ to 6.8% at 85, and it keeps growing. Taxes are paid on these withdrawals at the tax rates in effect at the time of each required annual minimum withdrawal.

Recent Market Volatility

-

-

- For retirement planning and estate building purposes, you may not want to accept ongoing equity market investment risks; this can be especially true as you get closer to retirement age.

- The potential for a 50+% loss of assets in a major market retreat (like we experienced in 2008 and 2009) is simply not acceptable!

- If equity market volatility is of concern to you, you may be seeking more stable product options that are accessible either inside or outside of your 401k, profit sharing or qualified plans.

- Business Planning Group has solutions to eliminate your equity market risks while converting your future taxable income to tax-free income

-

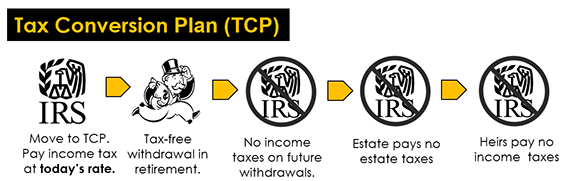

Let’s Discuss a Tax Conversion Plan (TCP)

Tax conversion plans allow your qualified funds to be converted from fully taxable at distribution to fully tax-free at distribution.

-

-

- Moving qualified funds into a tax conversion plan eliminates account “equity market risk” on that portion of your qualified plan that is moved into the TCP.

- Income taxes will be paid on the account value, at the then current rates, after the initial 5-year funding window.

- All future TCP earnings, withdrawals, and remaining estate funds will be distributed on a tax-free basis.

- There are no Federal or state income taxes applied to distributions as funds are distributed from your account during retirement.

-

You’ve spent a lifetime building up your retirement fund assets. Let’s talk about how you can convert those assets to tax-free funds, free of required minimum distributions so that you avoid equity market risks and generate maximum net proceeds.

The post Tax-free income with Tax Conversion Plans appeared first on Business Planning Group.

]]>The post Funding the Future with Leveraged Premium appeared first on Business Planning Group.

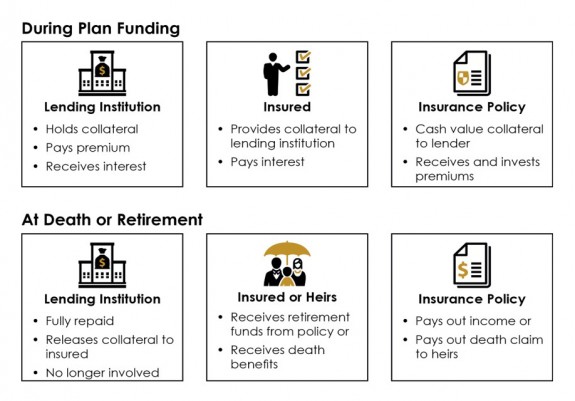

]]>Leveraged premium plans enable clients to leverage liquid assets to fund a life insurance policy. With a leveraged premium financing arrangement, the insured (or the insured’s trust or corporation) takes out a loan from a lender to pay the premiums on a life insurance policy. Here are a few benefits of leveraged premium plans:

- Funds are loaned, not earned. Leveraged plans reduce liquidity needs. This is helpful if your assets are not readily convertible to cash or are committed to other investments or expenses.

- You have an insurance need but current assets are employed in investments with returns that are higher than the cost of borrowing.

Leveraged premium plans have many uses, including:

- Retirement income planning

- Prefunding of a corporate buyout

- Estate maximization

- Estate Tax Replacement

- Legacy Planning

- Corporate liquidation value replacement

- Estate liquidity

- Corporate benefit planning

Here’s how leverage premium plans work:

Tax Considerations

- Interest on a loan to acquire life insurance is generally

considered personal interest and not tax deductible. - Since loans to a trust for premium payments are not taxable gifts, gift taxes can be minimized.

- Estate maximization

- Providing a personal guarantee or collateral on a loan does not cause an incident of ownership in the policy.

- If a policy can be structured inside of an irrevocable life insurance trust (ILIT), the policy and proceeds can be excluded from your estate value.

The post Funding the Future with Leveraged Premium appeared first on Business Planning Group.

]]>