Tax-free income with Tax Conversion Plans

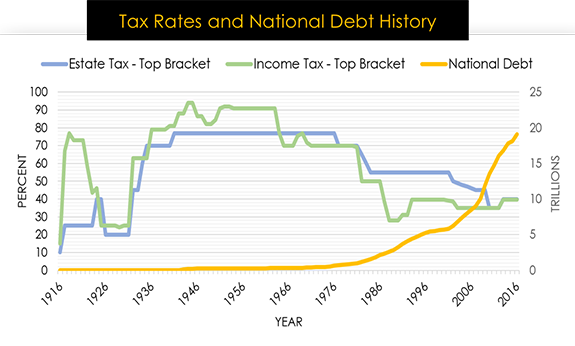

As our government struggles with growing debt, large deficits and spending levels, tax rates will no doubt be reevaluated and adjusted. Now fixed at the lowest historical levels for the last 80 years, when tax rates do go higher, the benefits of financial planning for the management of personal taxation will become increasingly important.

Without knowing what future tax rates will be, it will be in your best interest to plan to reduce both current and future taxation.

Managing Taxes

In order to reduce current taxes during your working years, people often invest in qualified plans such as IRA’s and 401(k) plans which provide the benefit of deferring taxation until you retire. However, Tax law requires qualified plan owners to begin taking “required minimum distributions” from their accounts, each year beginning at age 70½. The amount that must be taken from the account in any year is based on the age of the account owner. Required minimum distributions range from 3.7% of the account balance at 70½ to 6.8% at 85, and it keeps growing. Taxes are paid on these withdrawals at the tax rates in effect at the time of each required annual minimum withdrawal.

Recent Market Volatility

-

-

- For retirement planning and estate building purposes, you may not want to accept ongoing equity market investment risks; this can be especially true as you get closer to retirement age.

- The potential for a 50+% loss of assets in a major market retreat (like we experienced in 2008 and 2009) is simply not acceptable!

- If equity market volatility is of concern to you, you may be seeking more stable product options that are accessible either inside or outside of your 401k, profit sharing or qualified plans.

- Business Planning Group has solutions to eliminate your equity market risks while converting your future taxable income to tax-free income

-

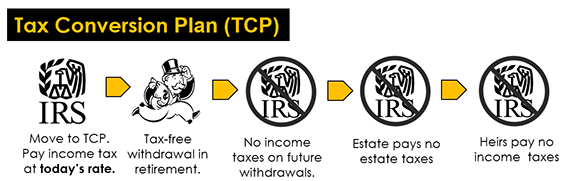

Let’s Discuss a Tax Conversion Plan (TCP)

Tax conversion plans allow your qualified funds to be converted from fully taxable at distribution to fully tax-free at distribution.

-

-

- Moving qualified funds into a tax conversion plan eliminates account “equity market risk” on that portion of your qualified plan that is moved into the TCP.

- Income taxes will be paid on the account value, at the then current rates, after the initial 5-year funding window.

- All future TCP earnings, withdrawals, and remaining estate funds will be distributed on a tax-free basis.

- There are no Federal or state income taxes applied to distributions as funds are distributed from your account during retirement.

-

You’ve spent a lifetime building up your retirement fund assets. Let’s talk about how you can convert those assets to tax-free funds, free of required minimum distributions so that you avoid equity market risks and generate maximum net proceeds.